What is copy trading?

Copy trading is an investment strategy where individuals replicate the trades of experienced and successful traders. This method allows less experienced investors to benefit from the expertise of seasoned traders without needing extensive market knowledge themselves. By automatically copying the trades, users can achieve similar returns to the trader they are following.

This strategy is facilitated by the Kudotrade Copier, which connects followers with proficient traders, ensuring transparency and efficiency. Copy trading offers a simplified approach to trading, making it accessible to a broader audience while leveraging the skills of professionals to potentially enhance investment performance.

Start trading like a professional

Are you a successful trader?

Replicate leading traders

Start from as low as 50 USD

Suitable for all level of traders

Link your MT5 accounts

Earn generously from profit sharing

Quick set up

Why use copy trading?

CopyTrading will be a great solution for you and KudoTrade is the powerful platform to provide that solution.

Easier way to trade

The Kudotrader Copier provides a straightforward method for identifying and automatically replicating the actions of traders. Simply select the traders you wish to copy!

Leverage expertise of top traders

Kudotrade Copier feature enables you to follow elite traders directly, eliminating the need for extensive market analysis.

Manage your risk

It is important to adjust your risk to match your personal risk settings based on your account size.

Never miss opportunities

Even whilst you rest, you can replicate trades from professional traders. Your portfolio remains active around the clock, capitalising on market opportunities.

Start Trading In Three Simple Steps

Frequently Asked Questions

What is a copy trading platform?

Copy trading is a form of trading where users can automatically copy the trades of experienced traders. When the trader you are copying makes a trade, the same trade is executed onto your account.

How do I start using the Kudo Copy Trader?

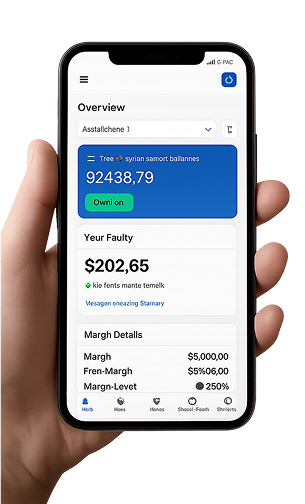

To start using the Kudotrade Copier platform, you need to download the app from your app store, create an account, deposit funds and choose a trade to copy based on their performance and strategy.

Can I stop copying a trader at any time?

Yes, you can stop following a trader at any time. The Kudotrade Copier provides you with the option to unfollow a trader, which stops any further trades from being copied to your account.

What’s the minimum amount needed to start?

You can utilise the Kudotrade Copier with an initial investment as low as $50.

How do I track my performance?

The Kudotrade Copier provides a dashboard where you can track the performance of your investments in real-time. You can view detailed reports, including profit/loss, trade history and other relevant metrics.

Can I copy multiple traders at once?

Yes, the Kudotrade Copier platform allows you to copy multiple traders simultaneously, enabling you to diversify your investment across various trading strategies and assets.

How can I find out more about a trader’s performance?

Detailed information about a trader’s performance, including their trade history, risk level and success rates, is available on the platform’s trader profile.

How often are trades copied?

Trades are typically copied in real-time or as soon as the original trader executes a trade. The frequency of trades depends on the trading activity of the trader you are copying.

What our traders are saying

"KudoTrade has transformed my trading experience. The platform is intuitive and provides all the tools I need to make informed decisions."

"The mobile app is outstanding. I can monitor my positions and execute trades from anywhere, which has been a game-changer for my investment strategy."

"The customer support team at KudoTrade is exceptional. They've helped me navigate complex trading scenarios with patience and expertise."

"I switched from a traditional broker to KudoTrade and haven't looked back. The commission-free trading and powerful analytics make this platform superior."